Confidently Buy with the Power of NPG Real Estate

Whether you're buying your first home or your next investment, NPG is here to guide you every step of the way. With expert agents, local insights, and real-time listings, your home-buying journey just got easier.

Detailed Step-by-Step Guide to Buying a House

Step 1: Check Your Finances

- Review your credit score (ideally 620+ for most loans; 740+ for best rates).

- Pay down debts if needed (credit card balances, car loans).

- Start saving for:

- Down payment (3%–20% of the home price, depending on the loan type)

- Closing costs (roughly 2%–5% of the price)

- Moving expenses

- Emergency fund (3–6 months’ expenses)

Step 2: Get Pre-Approved for a Mortgage

- Shop around and compare at least 2–3 lenders.

- Submit documents: W-2s, tax returns, pay stubs, bank statements, ID.

- Receive a Pre-Approval Letter stating your maximum approved loan amount.

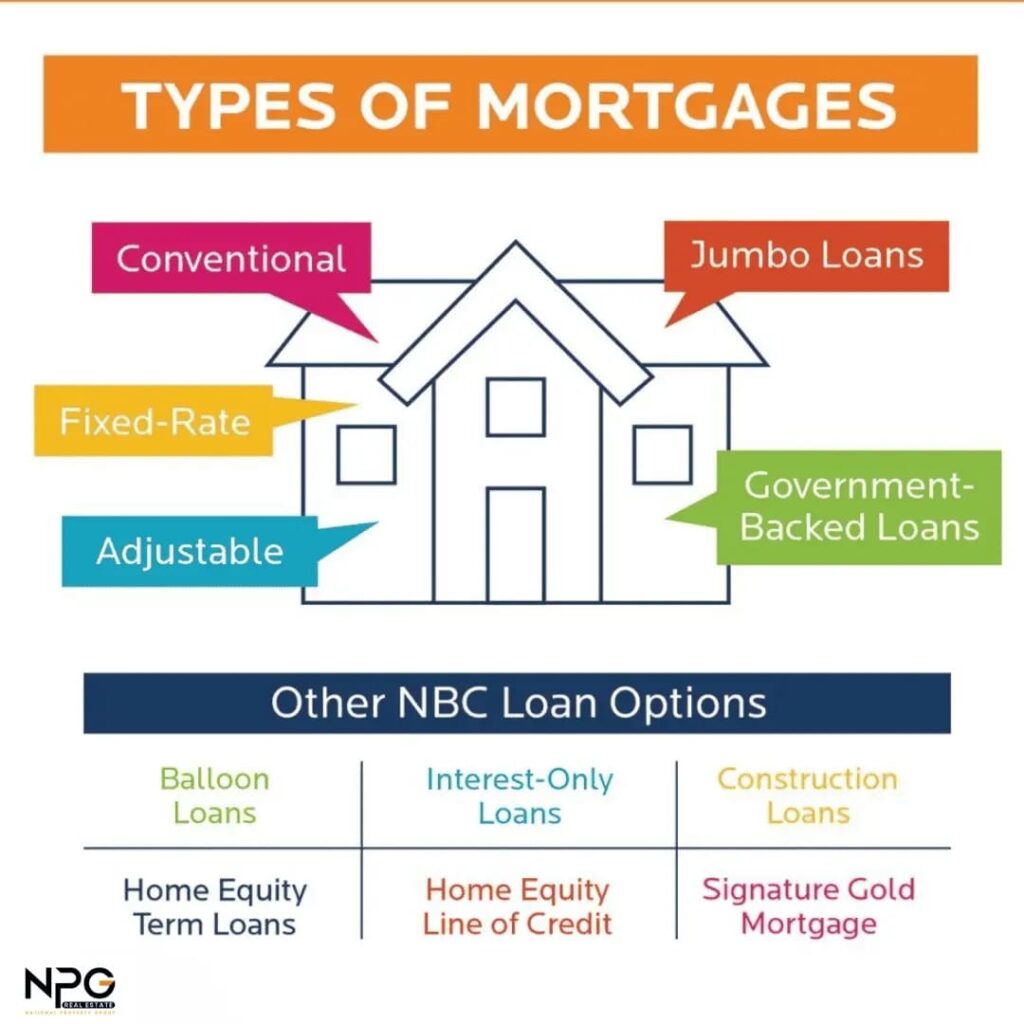

- Choose loan type: FHA, Conventional, VA, USDA

Why it matters: Pre-approval shows sellers you're serious and financially ready

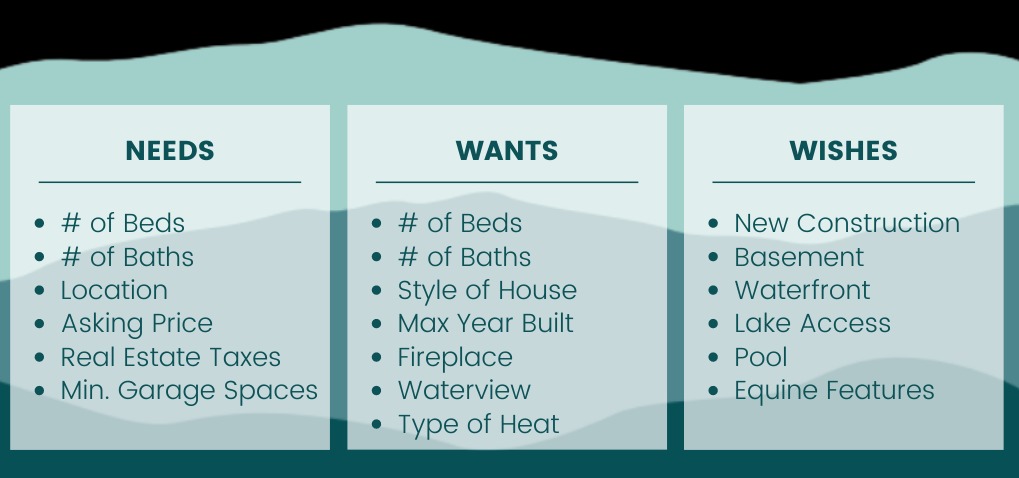

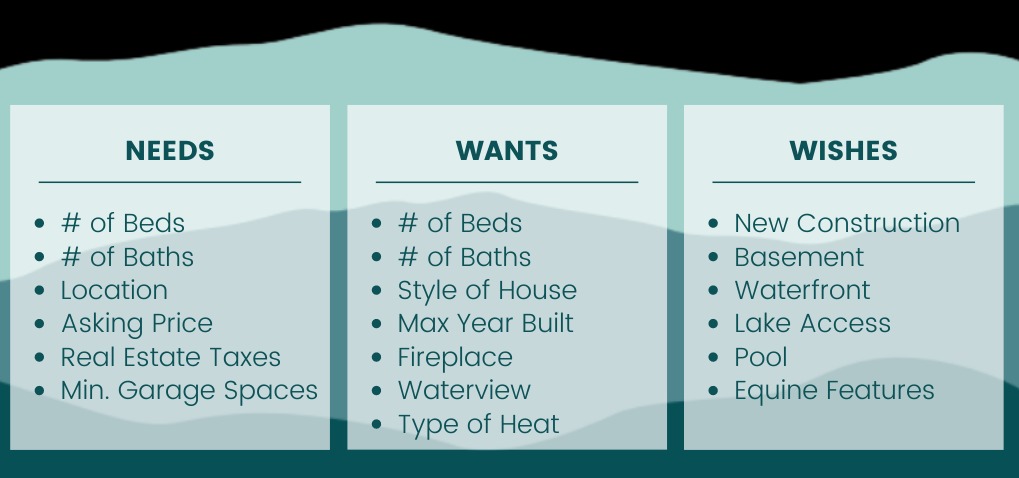

Step 3: Decide What You Want in a Home

- Create a "Must-Have" list (number of bedrooms, location, yard, etc.).

- Create a "Nice-to-Have" list (pool, finished basement, etc.).

- Decide on preferred neighborhoods, school districts, and commute times

Pro tip: You’ll rarely get 100% of what you want — focus on the top 3-5 priorities

Step 4: Hire a Real Estate Agent

Instead of searching on your own, partner with a knowledgeable agent who understands the local market. At NPG Real Estate, broker Masum Ahmed and his team are committed to guiding you every step of the way. We’ll help you find the right home, negotiate the best deal, and make the process smooth and stress-free.

Remember: As a buyer, your agent’s fee is usually paid by the seller.

Step 5: Start House Hunting

- Browse listings online (Zillow, Redfin, Realtor.com).

- Set up tours with your agent.

- Attend open houses

- Evaluate properties carefully: roof, foundation, layout, neighborhood.

Tip: Don’t get too emotional — this is a financial decision first.

Step 6: Make an Offer

– Review recent sales (“comps”) with your agent to choose an offer price.

– Include contingencies:

Home inspection contingency

Appraisal contingency

Financing contingency

– Decide on earnest money deposit (usually 1%–3% of the price).

– Sign and submit the offer

Tip: Be prepared for counter-offers or bidding wars, depending on the market.

Step 7: Offer Accepted → Go Under Contract

- Both sides agree to terms = you’re officially "under contract."

- Deposit your earnest money with the title company or escrow agent.

Step 8: Schedule a Home Inspection

- Hire a licensed inspector (cost: ~$300–$500).

- Attend the inspection if possible.

- Review the inspection report carefully.

- Negotiate repairs, price reductions, or even walk away if serious problems arise.

Step 9: Lender Orders an Appraisal

–The bank sends an appraiser to verify the home’s value.

–If appraisal is lower than offer price:

Renegotiate the price

Bring extra cash

Cancel the deal (depending on your contingency)

Step 10: Finalize Your Mortgage

- Lock your interest rate if you haven’t already.

- Submit any extra paperwork your lender needs.

- Receive a Loan Commitment Letter once final approval is done.

Step 11: Title Search and Title Insurance

– Partner with Pegasus National Title to handle your title work with speed and accuracy

– They research the property’s history to ensure it’s free of liens, unpaid taxes, or other legal issues

– Secure your new investment with title insurance that protects you from future ownership disputes or claims

Step 12: Get Homeowners Insurance

- Required before closing.

- Shop quotes and submit your chosen policy to your lender.

Step 13: Final Walk-Through

- 24–48 hours before closing.

- Check that the home is in the agreed condition.

- Confirm that repairs (if any) were completed.

Step 14: Closing Day

- Bring your government-issued ID.

- Bring a cashier’s check or wire transfer for closing costs.

- Review and sign final documents (mortgage, deed, disclosures)

Featured Homes for Sale

Browse handpicked listings that offer great value, location, and features.

48525 Oriole St, Utica, MI 48317

Welcome home to this inviting 3 bedroom, 2full bathroom, ranch-style...

- 3 beds

- 2 baths

- 1560 sq ft

8144 Timberline Dr, Shelby Township, MI 48316

Unlock the potential of this 3-bedroom, 1.5-bathroom gem offering 1,300+...

- 3 beds

- 1 bath

- 2389 sq ft

23749 Demley Dr, Clinton Township, MI 48035

Welcome to this Charming, Well Maintained Sprawling Brick Ranch Home!...

- 3 beds

- 1 bath

- 2565 sq ft

16115 Bayham Ct, Clinton Township, MI 48038

Multiple offers received. Offer deadline 5/12/25 @ 10AM**** Stunning ranch...

- 3 beds

- 1 bath

- 2601 sq ft

1733 Pembroke Rd, Birmingham, MI 48009

Welcome home to this one of a kind masterpiece tucked...

- 6 beds

- 4 baths

- 6164 sq ft

375 Catalpa Dr, Birmingham, MI 48009

Showings begin Friday, 5/9. Offers (if any) will be reviewed...

- 3 beds

- 3 baths

- 3584 sq ft

933 E Rowland Ave, Madison Heights, MI 48071

Welcome to this fully updated 3-bedroom, 2-bath ranch, ideally located...

- 3 beds

- 2 baths

- 1092 sq ft

29036 Milton Ave, Madison Heights, MI 48071

Welcome to your dream home! This fully renovated, move-in ready...

- 3 beds

- 1 bath

- 1708 sq ft

247 Hecht Dr, Madison Heights, MI 48071

BACK ON THE MARKET BUYER BACKED OUT. Brand new furnace...

- 3 beds

- 2 baths

- 1680 sq ft

26741 Dartmouth St, Madison Heights, MI 48071

Open Houses: 5/10 11AM-1PM; 5/11 1-3PM. A home full of...

- 3 beds

- 1 bath

- 2249 sq ft

351 E Farnum Ave, Madison Heights, MI 48071

OFFER DEADLINE OF SUNDAY, MAY 11 at 6pm* Welcome home...

- 3 beds

- 1 bath

- 1302 sq ft

14354 Bangor Dr, Sterling Heights, MI 48313

Welcome home! This all brick 3 bedroom, 2 full bathroom...

- 3 beds

- 2 baths

- 1532 sq ft

Tell Us What You’re Looking For

Home Buying Checklist

- Check credit score and finances

- Get pre-approved for a mortgage

- Hire a trusted real estate agent

- Create a "must-have" and "nice-to-have" list

- Start house hunting

- Make an offer

- Get the offer accepted and go under contract

- Deposit earnest money

- Schedule home inspection

- Review inspection report and negotiate repairs

- Lender orders home appraisal

- Finalize mortgage approval

- Shop and purchase homeowners insurance

- Shop and purchase homeowners insurance

- Schedule utilities to start

- Final walk-through of the home

- Bring ID and funds to closing

- Sign documents and get your keys

- Move in and change locks

- Celebrate becoming a homeowner!